Crypto Tokens vs. RWA Tokens:

Understanding the Key Differences

March 17, 2025

Blockchain technology is revolutionizing finance in two major ways: through cryptocurrency tokens and real-world asset tokenization. Crypto tokens function as a form of money that is purely digital, while RWA tokens represent and are backed by existing physical assets. While both use blockchain technology, they serve different purposes, follow different rules, and have different appeals. Knowing the key distinctions between these two asset types is essential to understanding how digital assets are shaping the future of capital markets.

Defining Crypto Tokens and RWA Tokens

The term ‘cryptocurrency token’ generally refers to digital tokens created on blockchain platforms like Ethereum, Solana, or Avalanche that are not directly tied to any underlying physical asset. Therefore, these tokens tend to be volatile, and their value is predominantly determined by the following factors:

– Market demand

– Utility

– Scarcity

In contrast, real-world asset (RWA) tokenization involves creating blockchain-based tokens that represent ownership or rights to tangible assets. RWA tokens are tethered to the valuation of the underlying asset they represent. Tokenization leverages the speed, reliability, and efficiency of blockchain technology to provide a new financial infrastructure for the ownership of physical assets. Examples include stablecoins, real estate, commodities, or financial instruments.

Purpose and Use Cases

Crypto tokens function as a form of decentralized currency that provide value or utility on blockchain platforms. Many follow ERC-20, a widely used standard for creating fungible tokens on Ethereum, powering DeFi applications like lending, staking, and liquidity provision. They also enable decentralized governance through DAOs (Decentralized Autonomous Organizations), which are community-driven entities where decisions are made collectively through token-based voting.

The most common use case for RWA tokenization to date is stablecoins: digital tokens pegged to national currencies, such as the U.S. dollar. Users can redeem their USD stablecoin for US Dollars at any time as long as they meet the minimum redemption amounts. Stablecoins are emerging as a leading digital currency due to their transactional speed and efficiency, especially with cross-border payments. Tether (USDT) is the largest stablecoin provider, with over $143 billion USDT in circulation as of March 2025, allowing users to hold and transfer value globally without exposure to volatility.

Other uses RWA use cases include Tether Gold (XAU₮), which allows investors to own fractional shares of physical gold stored in Swiss vaults, with 24/7 tradability. While tokenized gold was one of the earliest tokenized RWA use cases, any physical commodity can be tokenized, such as precious metals and agricultural products.

Oil and energy assets benefit from tokenization by reducing transaction costs and enabling fractional ownership. Tokenized mineral rights let landowners monetize underground resources without giving up land ownership, while carbon credits support sustainable energy practices. In agriculture, tokenization of crops like soybeans, wheat, and coffee gives farmers direct access to capital while improving supply chain efficiency. Another use case is a tokenized real estate project, which can divide ownership into digital shares, allowing fractional investment.

DeFi integration enables collateralized loans and asset-backed stablecoins, using tokenized assets such as gold and oil as alternative collateral.

Underlying Technology

While both crypto and RWA tokens leverage blockchain technology, their implementations differ significantly. Crypto tokens exist as assets on their respective blockchain ecosystems and operate on decentralized networks. These digital assets gain value based on factors such as scarcity, utility, and network adoption.

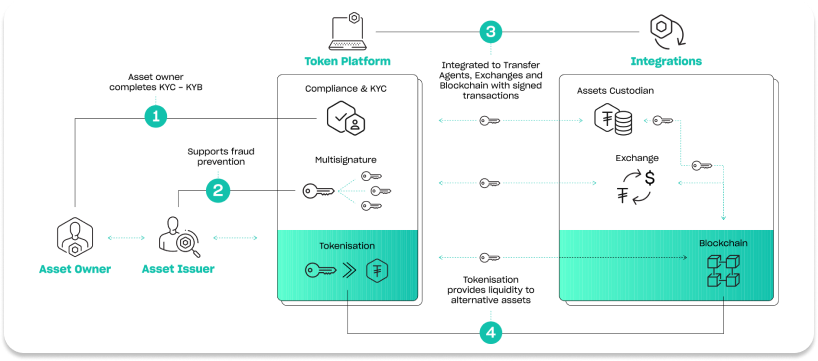

RWA tokenization relies on blockchain but is specifically designed to digitally represent real-world assets. This process involves using smart contracts, which are self-executing agreements with terms written in code, to automate ownership management and transactions, ensuring that asset transfers remain transparent, efficient, and secure. These tokens adhere to widely accepted blockchain standards, such as ERC-20 for fungible assets, enabling interoperability across multiple networks.

Oracles, which are tools that connect blockchains to external data sources, play a crucial role in integrating off-chain data—such as real estate valuations, gold reserves, or financial instruments—into blockchain environments, ensuring that tokenized assets accurately reflect their real-world counterparts.

To enhance security and efficiency, Hadron by Tether integrates with established blockchain infrastructures that prioritize regulatory compliance, security, and customization. These collaborations offer a proven and reliable framework for secure asset tokenization while maintaining the fundamental principles of decentralization. Multi-chain architectures further enable issuers to tailor their tokenized assets to meet specific regulatory and market requirements, ensuring flexibility across different jurisdictions.

Beyond improving efficiency, RWA tokenization is paving the way for new capital markets, particularly in commodities and financial instruments. By digitizing traditionally illiquid assets, institutions, governments, and businesses can increase liquidity, unlock capital for large-scale projects, and attract a broader base of global investors. This approach fosters economic development by transforming physical assets into easily tradable, accessible financial instruments on blockchain networks.

The Next Generation of Capital Markets

Blockchain technology is disrupting global finance by enabling borderless transactions, decentralized applications, and new forms of value exchange.

RWA tokens are at the forefront of the next generation of capital markets, transforming how assets are owned, traded, and valued. By bridging traditional finance with blockchain technology, they unlock new levels of liquidity, transparency, and accessibility, enabling fractional ownership of high-value assets and reducing barriers to investment. As adoption grows, RWA tokens have the potential to reshape global markets, making them more efficient, inclusive, and resilient in the digital economy.

A Tokenized Future

Hadron by Tether gives banks, financial institutions, and businesses the tools to manage digital assets securely, stay compliant, and improve efficiency. Tokenization increases liquidity and unlocks new market opportunities, giving businesses a competitive edge. As blockchain continues to reshape finance, we help our partners and clients stay ahead—leading the way rather than catching up.

加入Hadron by Tether今天

开始您的旅程,迎接金融新时代。无论您是寻求发行还是投资,Hadron by Tether为您提供最全面的技术支持和成功所需的工具。