Tokenization:

The Future of Commodities

December 06, 2024

Summary

Tokenization is redefining asset ownership, accessibility, and trading in financial markets. As tokenization progresses, it has the potential to unlock tremendous value in the commodities sector, empowering a wider range of investors to participate in markets that can offer both resilience and growth potential. The tokenized commodities industry is young and rapidly expanding, with a market size of ~$1.3 billion as of November 2024 and YoY growth of ~25%

By creating digital tokens that represent physical assets such as precious metals, energy commodities, and agricultural products, issuers have the potential to create broader investment access and market participation. This approach could introduce greater liquidity and transparency, enabling assets to be traded more freely on blockchain networks while reducing dependence on intermediaries. Fractional ownership allows investors to diversify their portfolios with digital real-world assets, leveraging the efficiency of blockchain technology.

Hadron by Tether is an asset tokenization platform that simplifies the process of converting various assets into digital tokens. With its seamless and intuitive interface, the platform allows users to easily tokenize stocks, bonds, commodities, funds, and reward points. This opens up new opportunities for individuals, businesses, and even nation-states to raise funds using tokenized collateral.

Background

The shift towards tokenized assets is reshaping the financial landscape, particularly within the commodities sectors. Tokenization allows traditional assets—such as precious metals, energy commodities, and agricultural products—to be divided into digital tokens that represent ownership. This new approach enables broader market access, enhanced liquidity, and real-time trading capabilities on blockchain networks, a structure that was previously limited to specific financial institutions and high-net-worth investors. Global demand for alternative assets is increasing rapidly, driven by investors seeking diversification and stability in uncertain economic environments. Tokenized commodities provide a bridge between physical assets and digital finance, offering investors secure, divisible ownership in real assets. In leveraging blockchain technology, tokenized commodities provide enhanced transparency by recording every transaction on an immutable public ledger, ensuring security through decentralized validation, and improving efficiency through faster, lower-cost transactions without the need for intermediaries. Our platform supports these transitions by providing a unified framework for tokenized asset issuance and management, designed to integrate seamlessly with existing financial structures.

Main Drivers for Change

1. Demand for Diversification and Stability

With global markets increasingly impacted by economic and geopolitical uncertainty, there is a growing demand for alternative investment options. Commodities offer an alternative investment vehicle to traditional bonds and equities. Some commodities can act as a store of value or serve as a hedge against volatility in traditional markets. Tokenization democratizes access to these assets, which are now available at a fraction of the cost, allowing retail investors to participate alongside institutions. An example of this is Tether Gold ($XAUT) which sees over $6mm in daily trading volume, as of November 2024.

2. Rapid Settlement and Operational Efficiency

Blockchain technology has introduced new levels of transparency, security, and efficiency in asset management. Tokenized assets are recorded on immutable ledgers, reducing reliance on intermediaries and enabling faster, cost-effective transactions. For example, commodity ETF’s are usually settled in one business day (T+1) whereas gold backed stable coins like $XAUT are settled instantaneously or within couple of minutes. Hadron by Tether’s multi-chain architecture provides institutions with flexible, scalable solutions to manage these digital assets, making it easier for both large institutions and individual investors to access and trade these commodities, with settlement in real-time 24/7/365.

3. Growing Institutional and Retail Interest in Real-World Asset (RWA) Tokenization

Tokenization platforms are gaining traction among institutions that want to manage assets digitally while still retaining exposure to tangible, real-world assets. Our platform supports commodity-backed tokens, enabling banks, investment funds, and retail investors to engage with assets like gold, oil, and agricultural products in ways that enhance liquidity and expand market accessibility.

4. Enhanced Financial Inclusion

Tokenization allows fractional ownership, which makes trading logistically easier for retail investors thus lowering the barrier to entry for individual investors to own assets that were previously out of reach. By enabling retail participation in assets like precious metals and agricultural commodities, tokenization supports a more inclusive financial system, extending investment opportunities to a wider audience.

Hadron by Tether: The Technology Behind Tokenized Capital Markets

Hadron by Tether Real World Asset (RWA) Tokenization Platform

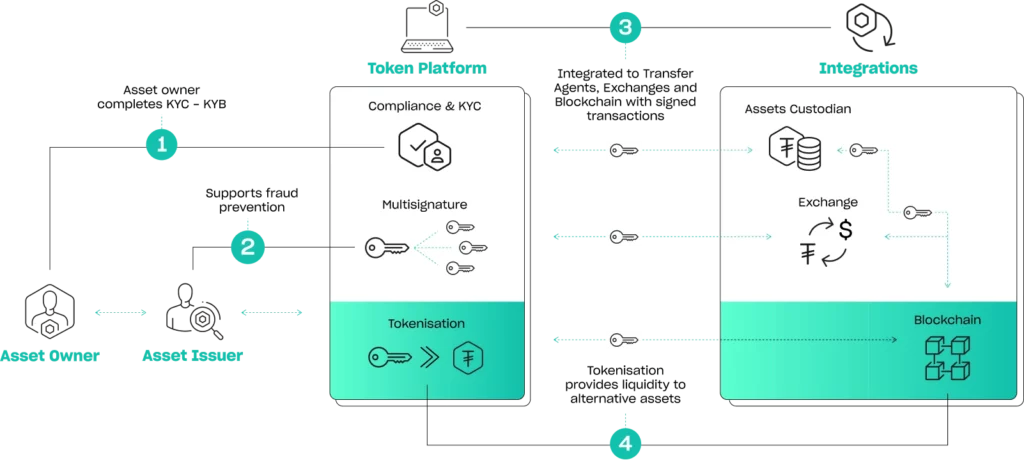

Integration, Comprehensive Technology Platform

Hadron by Tether provides institutions with the tools they need to help them facilitate secure, compliant and efficient transactions in a modern digital economy.

The platform is integrated with leading blockchains, allowing for seamless customization. This includes Liquid, a Bitcoin sidechain that leverages Bitcoin’s proven architecture to help ensure the secure tokenization of real-world assets. Liquid’s established code base preserves the essential security features of the Bitcoin blockchain, providing a reliable foundation for global capital markets.

Our multi-chain architecture means seamless interoperability, enabling issuers a high level of customization in applying specific requirements. This flexibility empowers issuers to tailor their offerings to meet its regulatory and market needs, further enhancing Hadron by Tether’s utility.

New Capital Markets with Tokenized Commodities

Tokenizing commodities enables institutions, exchanges, and governments to create more transparent and efficient capital markets by transforming traditionally illiquid assets into accessible, tradable forms. With tokenized commodities, institutions can unlock capital for critical projects and drive sustainable growth in both established and emerging markets. By tokenizing real-world assets, Hadron by Tether empowers partners to build diversified ecosystems that attract global investors, stimulate economic development, and support long-term prosperity.

Tokenized Commodities: Current & Potential Use Cases

1. Tether Gold (XAU₮)

Tether Gold enables investors to own physical gold on the blockchain, combining the security of a stable, real-world asset with the flexibility of digital tokens. Each XAU₮ token represents ownership of one troy ounce of physical gold, and the gold is stored in secure Swiss vaults. XAU₮ addresses storage and transaction limitations of physical gold while providing fractional ownership and 24/7 liquidity. This asset operates independently of traditional markets, making it accessible even when conventional gold exchanges are closed, thus broadening investment options for retail and institutional investors.

2. Precious & Industrial Metals

Tokenization of precious metals allows secure, divisible ownership of assets previously reserved for high-net-worth individuals and institutions. As of November 2024, gold tokens account for around 90% of all tokenized commodities, with a market capitalization of ~$1.17B.

In addition to gold tokens like Tether Gold, tokenization could be applied to other precious metals such as silver, platinum and palladium whose combined annual market size is over $30 billion. This would also apply to industrial metals such as aluminum, copper and nickel.

This would enable investors to buy fractions of metal units, broadening access and offering a stable asset class within the digital finance ecosystem. The ability to trade precious metals 24/7 on blockchain networks enhances liquidity and provides a reliable store of value for both institutional and retail investors.

3. Oil and Energy Commodities

Tokenizing energy commodities, such as oil and natural gas, introduces new liquidity and democratizes access to traditionally exclusive markets. By removing intermediaries, Hadron by Tether allows investors to hold fractional shares in energy reserves, reducing transaction costs and enhancing transparency. Additionally, tokenized carbon credits provide incentives for sustainable energy practices, allowing institutions to create and trade digital tokens representing emissions reductions.

Potential features of oil/energy tokens:

Tokenization of mineral rights: allowing landowners to sell the rights to oil beneath their land without giving up ownership of the land itself.

Royalty distribution: Oil companies lease these mineral rights and pay a share of their profits to the rights’ owners. For example, if an oil operator produces $1 million worth of oil in a month, they distribute 25% to the mineral rights’ owners.

Yield potential: A token issuer could offer a tokenized fund owning mineral rights on land operated by an oil & gas company, and offering a specified yield.

4. Agricultural Products

Tokenizing agricultural commodities, including crops, carbon credits, and livestock, supports transparency and traceability in the agricultural supply chain. With Hadron by Tether’s infrastructure, investors can own fractional shares in agricultural products, making it easier for institutions to promote sustainable farming practices. Tokenized agricultural assets are ideal for socially responsible investors, enabling sustainable funding mechanisms for farms while providing a stable source of income through dividends or yield farming.

Potential features of agricultural tokens:

Tokenization of major crops such as soybeans, corn, wheat, coffee and sugar cane offer investors a new channel to access agricultural investments.

Each token would be backed by and represents one ton of grain, or similar unit.

Tokenization allows farmers to store, invest, and transact with their grain production, potentially removing intermediaries and reducing costs

This can provide small and medium-sized farmers with access to new funding sources through tokenized assets.

5. Integration with Decentralized Finance (DeFi)

Hadron by Tether can be integrated into DeFi platforms, enabling new financial strategies, such as collateralized loans, yield farming, and asset-backed stablecoin issuance. Tokenized assets such as gold and oil offer an alternative form of collateral, making DeFi accessible to investors looking to diversify outside of crypto assets. This approach enhances portfolio diversification while providing liquidity and risk management options that were previously unavailable in traditional finance.

About Hadron by Tether

Hadron by Tether is an asset tokenization platform that simplifies the process of converting various assets into digital tokens. With its seamless and intuitive interface, the platform allows users to easily tokenize stocks, bonds, commodities, funds, and reward points. This opens up new opportunities for individuals, businesses, and even nation-states to raise funds using tokenized collateral.

The platform offers a range of tools, including asset issuance and burning, KYC (Know Your Customer) compliance, blockchain reporting, capital market management, and regulatory guidance. By making asset tokenization more accessible, Hadron by Tether aims to revolutionize the finance sector and shape the future of money.

Únete a Hadron by Tether hoy

Empieza tu viaje hacia la nueva era de las finanzas. Si deseas emitir o comprar, Hadron by Tether proporciona la tecnología y el apoyo más completo que necesitas para tener éxito en la revolución de los activos digitales.