How Institutions Can Leverage Stablecoins to Drive Profitability and Global Market Efficiency

January 14, 2025

Summary

The global market for stablecoins is rapidly expanding, with over 100 million users now utilizing these digital assets across various platforms. The number of wallets holding stablecoins increased by 15% from January to April 2024, highlighting the growing adoption and trust in these currencies. There is significant room for established institutions to innovate and capture market share by issuing their own asset-backed stablecoins.

Stablecoins provide financial institutions a strategic advantage by enabling faster transactions, reducing costs, and enhancing security, especially in cross-border payments where they bypass slow, costly traditional banking systems.

Issuing stablecoins enables financial institutions to access new markets and serve underbanked populations, driving financial inclusion and positioning them as leaders in the digital economy.

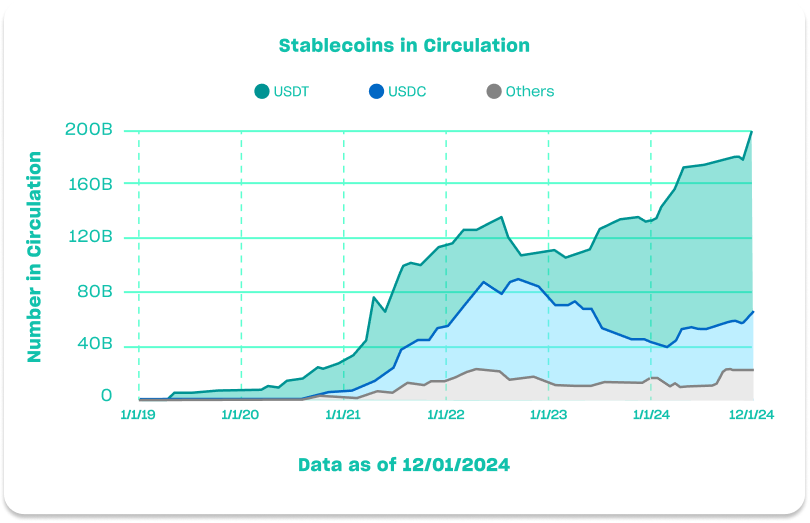

As of November 1, 2024 there were over $162 billion of stablecoins in circulation. The most popular is USDT – issued by Tether, with over $120 billion in circulation.

Background

The global financial system is undergoing significant changes as markets become more complex and the demand for modernization grows. Major drivers behind this include increasing demand for digital assets and alternative assets, especially among younger generations. Meanwhile, the greatest wealth transfer in history is occurring. By 2045, $84.4 trillion is projected to shift from older to younger generations.

Financial institutions are facing the challenge of integrating traditional instruments with these emerging digital assets. Stablecoins have become an essential tool, offering a stable, digital alternative to conventional currencies that can be utilized across various financial services

Stablecoins enable financial institutions to increase transaction efficiency, lower costs, and improve access to global markets. As the digital economy continues to expand, these digital assets are becoming crucial for large organizations striving to stay competitive and enhance profitability.

Just as traditional financial infrastructures were developed to support the needs of growing economies, stablecoins represent the next generation in financial markets. By offering a dependable, asset-backed digital currency, established institutions can use stablecoins to optimize liquidity, streamline cross-border transactions, and expand their service offerings to better meet the needs of a global and increasingly digital customer base.

Main Drivers for Change

Research has isolated five (5) main reasons for the rapid adoption of stablecoins among users and financial institutions:

1. Growing Market Demand

The stablecoin market is expanding rapidly, with increasing user adoption and a growing number of wallets, highlighting their acceptance as a reliable digital currency.

2. Faster, For Less

By reducing intermediaries and simplifying processes, stablecoins enable near-instant transactions. This significantly improves efficiency and lowers costs for trading, remittances, domestic and cross-border payments.

3. Increased Security and Transparency

Blockchain’s decentralized nature provides enhanced security against fraud and ensures transparent, traceable transactions for regulatory compliance.

4. Financial Inclusion

Stablecoins extend financial services to unbanked and underbanked populations opening new markets for financial institutions.

5. Liquidity Management

Stablecoins provide a stable value, making them a reliable tool for liquidity management and a preferred means of exchange within financial systems.

Business Model

Hadron by Tether Real World Asset (RWA) Tokenization Platform

The business model for stablecoin issuance by financial institutions is built upon leveraging existing assets to create a profitable and scalable system. This model revolves around issuing stablecoins backed by the institution’s assets, such as government treasuries, to meet the growing demand for digital currency.

Asset Utilization and Interest Rate Impact

By issuing stablecoins, financial institutions can attract more users into their network and increase profitability. These assets can be invested in low-risk, high-yield government treasuries, creating a steady revenue stream. The profitability of this model is sensitive to interest rate fluctuations:

Rising Interest Rates: When interest rates increase, the returns from treasuries also rise, enhancing the yield on the assets backing the stablecoins.

Falling Interest Rates: Lower interest rates may decrease the yield from treasuries, but this is often offset by increased velocity and demand for stablecoins as more users turn to them for transactions due to the stability and low transaction costs.

Facilitating Transactions and Reducing Costs

Stablecoins offer significant advantages for peer-to-peer (P2P), business-to-business (B2B), and business-to-consumer (B2C) transactions, particularly in international markets. For example, a Brazilian company purchasing goods from Vietnam currently faces multiple currency conversions, foreign exchange (FX) charges, and time delays through the traditional banking system. By contrast, stablecoins allow for instant settlement with minimal fees, as both parties transact in a digital dollar that is stable and universally accepted.

Expanding Access to Financial Products

Beyond transaction facilitation, stablecoins open new avenues for financial institutions to offer yield and credit products. More and more small and medium-sized businesses (SMBs) in international markets choose stablecoins to settle transactions, recognizing the benefits of speed, cost-efficiency, and stability. This trend creates opportunities for financial institutions to provide services such as payroll solutions, lending, and investment products tailored to the needs of these businesses.

Current Market Adoption

The market for stablecoins is rapidly expanding, with $7 trillion in value settled through stablecoins in 2023 alone, according to Coinmetrics. Companies like BVNK have settled $6 billion in global B2B transactions using stablecoins, and major financial services providers such as Visa, PayPal, and Stripe have launched their own stablecoin solutions. A MasterCard study further highlights that one in three merchants in Latin America already transact in stablecoins, underscoring the growing adoption and demand.

Incorporating stablecoin issuance is not just profitable for financial institutions, it’s a must to stay competitive and aligned with the global shift towards digital assets. By leveraging existing assets, institutions can capitalize on the growing demand for stablecoins.

B2B Use Cases

Stablecoins offer B2B solutions that surpass traditional financial systems in speed, efficiency, and cost savings. Three key applications demonstrate their transformative impact on business operations:

1. Distribution Channel to New Users

Leading financial institutions are faced with the challenge of attracting younger generations of investors. The generational wealth transfer, involving tens of trillions of dollars, is driving a shift in investor preferences. Millennials and Gen Z, set to inherit this wealth, favor digital assets and tech-driven financial solutions. By integrating stablecoins into their offerings, financial institutions can attract tens of millions of new users.

Old way: Investors from the generation of Boomers and Gen X prefer to deposit their funds into brokerages or purchase Money Market Funds.

New way: Investors from the Generation of Millenials and Gen Z prefer to deposit their funds into digital asset exchanges or purchase tokenized assets.

2. Merchant Settlements

For fintech companies that move money on behalf of their merchants, the ability to settle transactions quickly and reliably is a critical competitive advantage. Stablecoins are designed for speed – allowing payment providers to offer faster settlement times compared to traditional systems like SWIFT, especially for cross-border transactions. This not only speeds up the payment process but also reduces the need for holding capital in pre-funded accounts.

Old Way: Traditionally, fintech companies collect payments in local currencies, convert them to euros, dollars, or pounds, and then transfer the funds to merchants via SWIFT. This process typically takes 2-5 days for funds to settle.

New Way: By converting fiat currency to stablecoins, fintech companies can send funds directly to the stablecoin wallet of an international merchant within minutes. This method is already being tested by some of the world’s largest payment companies, including Visa, Worldpay, and Nuvei.

3. Payouts

Stablecoins offer a unified solution for various payout needs, including merchant settlements, consumer refunds, withdrawals, winnings, and salary payments. This approach is particularly advantageous in regions where traditional methods are slower, costly, and less reliable.

Old Way: Fintech companies and businesses traditionally processed payouts through payment cards, bank accounts, digital wallets, or mobile money apps. These transactions, especially for international payments, often took days to settle and incurred high fees. Currency conversions were also a challenge, particularly in volatile markets, leading to potential losses in value for recipients.

New Way: With stablecoins, payouts can be made within minutes and cost-effectively. Whether settling merchant transactions, issuing consumer refunds, or paying contractors, stablecoins eliminate the need for currency conversions and reduce fees. This new method offers recipients the option to hold digital dollars, providing stability in volatile markets and significantly speeding up the payment process.

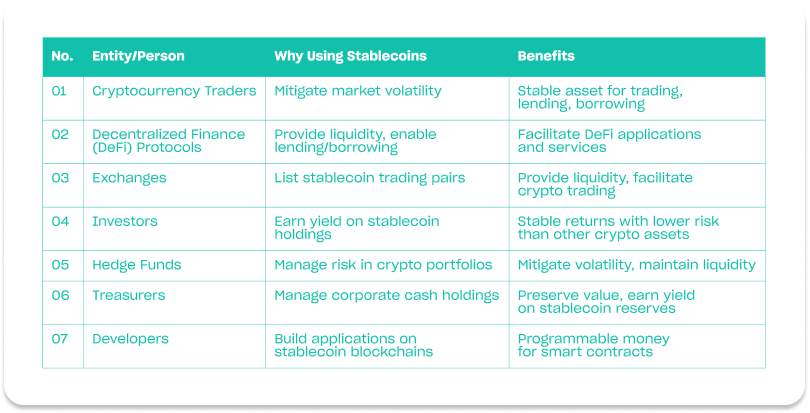

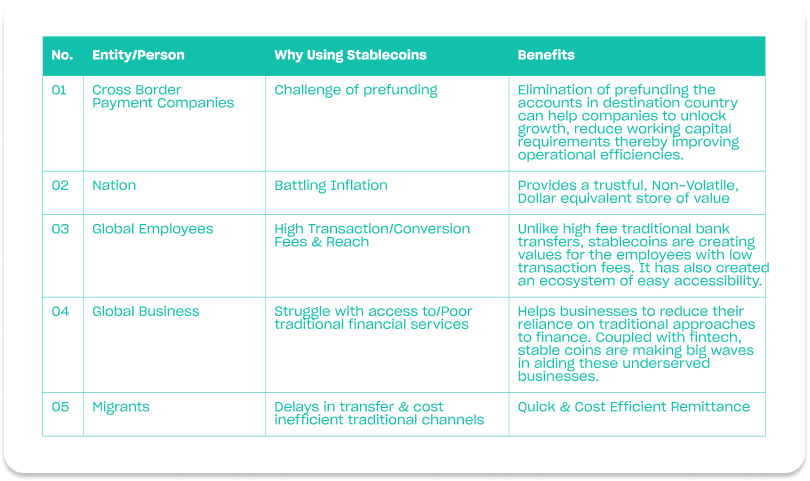

Individual Use Cases Note

Here are some of the key ways in which individuals are leveraging stablecoins:

Financial Inclusion & Global Access:

Stablecoins provide individuals with a secure way to participate in international financial markets, enabling them to engage in global debt and credit transactions. These financial services might otherwise be out of reach.

Secure & Stable Currency:

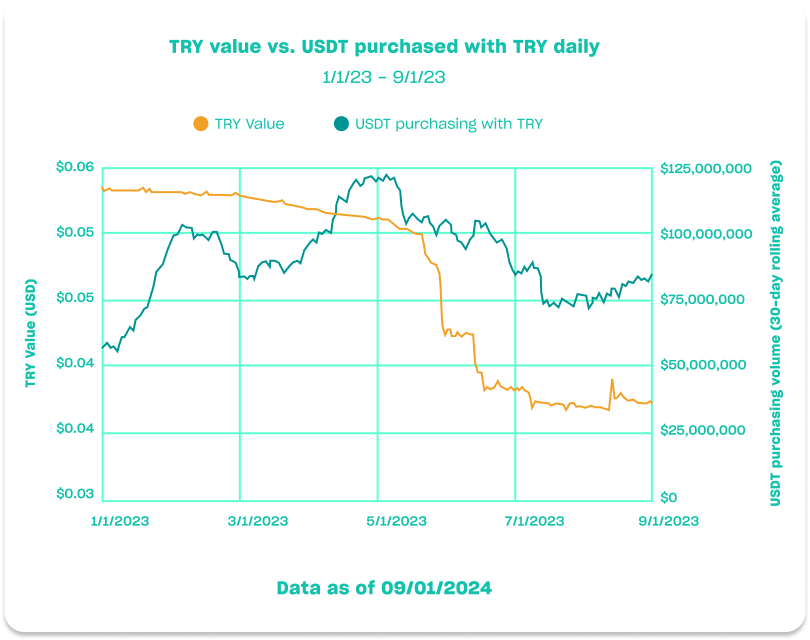

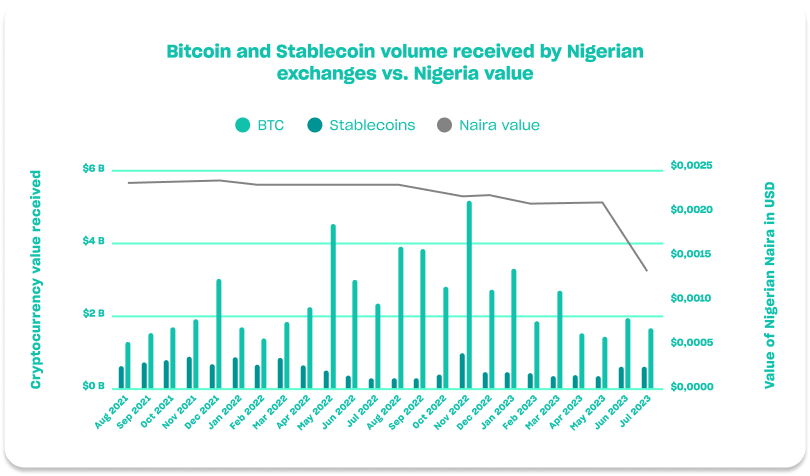

Many individuals use stablecoins to store value, especially in regions where local currencies are unstable due to censorship, inflation, or other economic issues. For example, in Turkey in 2023, citizens were selling nearly $100mm of Turkish Lira monthly to buy and hold USDT.

In 2022 & 2023, similar trends appeared across locations such as Nigeria, Vietnam, Ukraine and multiple countries in Latin America and sub-Saharan Africa. Stablecoins became the most used cryptocurrency in these locations, as they offered both price stability and utility.

Alternative to Traditional Financial Systems:

Accessing dollars through conventional banking channels can be expensive and complicated. Stablecoins offer a more accessible and cost-effective alternative.

Rapid & Low-Cost Remittances:

Stablecoins can be easily acquired and transferred over the internet. Individuals use stablecoins to send and receive remittances across borders quickly and at a lower cost compared to traditional methods.

Looking Ahead

As the global financial system evolves, stablecoins are set to play a crucial role for large institutions. By adopting stablecoin issuance, these organizations can enhance efficiency, access new markets, and offer faster, more cost-effective transactions. This positions stablecoins as a key driver of profitability and market expansion. Financial institutions and established organizations that integrate stablecoins will benefit from customer acquisition, cost savings, and a stronger competitive edge, while also supporting global trade and financial inclusion. Embracing stablecoins is essential for leading in a rapidly digitizing world.

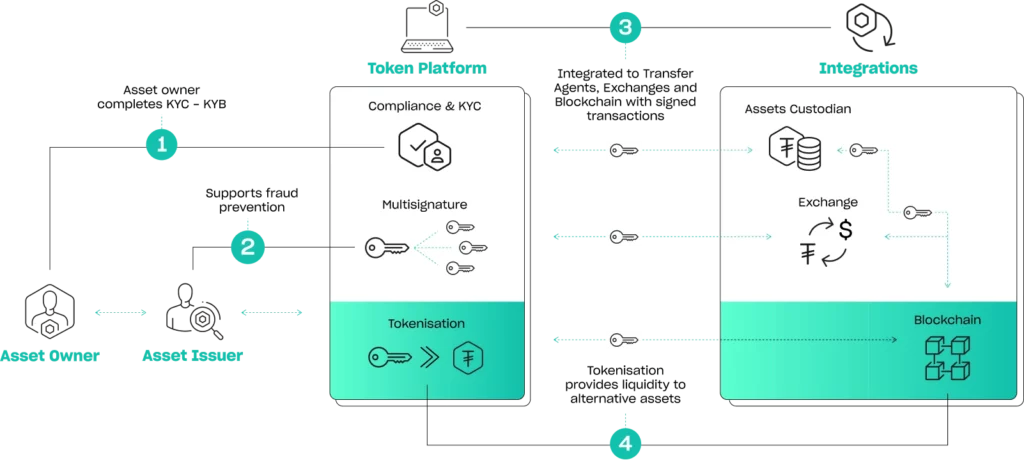

About Hadron by Tether

Hadron by Tether is an asset tokenization platform that simplifies the process of converting various assets into digital tokens. With its seamless and intuitive interface, the platform allows users to easily tokenize stocks, bonds, commodities, funds, and reward points. This opens up new opportunities for individuals, businesses, and even nation-states to raise funds using tokenized collateral.

The platform offers a range of tools, including asset issuance and burning, KYC (Know Your Customer) compliance, blockchain reporting, capital market management, and regulatory guidance. By making asset tokenization more accessible, Hadron by Tether aims to revolutionize the finance sector and shape the future of money.

Join Hadron by Tether Today

Start your journey towards the new era of finance. Whether you are looking to issue or purchase, Hadron by Tether provides the most comprehensive technology and support you need to succeed in the digital asset revolution.